Find out how understanding the differences between home appraisals and inspections can impact your real estate decisions; the details might surprise you.

Continue readingCommon Fears Real Estate Agents Face and How to Handle Them

With the unpredictable nature of real estate, discover how to confront common fears and turn them into opportunities for success. Are you ready to learn more?

Continue readingAddressing Title Issues in Property Transactions

Just how critical is it to address title issues in property transactions? Discover strategies to navigate these challenges and safeguard your investment.

Continue readingUnderstanding Deed Restrictions

Mastering deed restrictions is crucial for homeowners, as these rules can shape your living experience in unexpected ways. What might you be overlooking?

Continue readingReal Estate Investing: A Beginner’s Guide

Real estate investing remains a top method for generating income and building wealth, appealing to those aiming to create passive income, diversify their investment portfolio, or attain financial freedom. This investment avenue can serve as your ladder to achieving these ambitions.

Beginning this lucrative venture might seem daunting at first. One way to simplify the process is by obtaining a real estate license. This not only equips you with a thorough understanding of market dynamics, property laws, and transaction processes but also opens doors to exclusive listings and networking opportunities with industry professionals. By enrolling in our online courses at Chamberlin Real Estate School, you can gain the knowledge and credentials needed to navigate the real estate market confidently.

This guide is crafted for beginners eager to explore the area of real estate investments. Here, we’ll discuss various investment types within real estate, the vital skills for success, strategies to enhance returns, and a realistic look at the potential risks and rewards. Additionally, we will outline the initial steps necessary to venture into real estate investing.

After reading this article, you’ll possess a thorough understanding and the confidence needed to start your investment path in real estate. But first, let’s clarify what real estate investing entails and the reasons to consider it.

Understanding Different Types of Real Estate Investments

Real estate encompasses a wide array of property types and assets, each offering different opportunities based on your investment goals, budget constraints, and appetite for risk. Whether you’re looking to dive into one category or diversify across several, the field of real estate is rich with potential.

Residential Real Estate

Residential real estate covers properties designed for living purposes, including single-family homes, multifamily units, apartments, condos, and townhouses. Investors in this sector often purchase properties to rent them out, aiming for rental income and property value appreciation over time. While residential real estate can be an optimal starting point for newcomers due to its relative accessibility, it demands ongoing management, upkeep, and adherence to legal standards. If you’re planning to invest in this sector, having a real estate license can give you an edge. It allows you to legally manage your properties, access the Multiple Listing Service (MLS) for better deals, and enhance your credibility with tenants and partners. Consider reviewing real estate license requirements to what is required in getting the license process started.

Commercial Real Estate

Properties utilized for business operations, such as office spaces, retail outlets, hotels, eateries, and warehouses, fall under commercial real estate. Investors here tend to lease spaces to businesses, securing rent payments, often under long-term agreements, leading to substantial returns. Though commercial real estate generally presents higher costs and complexity compared to its residential counterpart, it also provides a pathway to greater financial stability and portfolio diversification.

Land

This category includes undeveloped or semi-developed parcels of land, free from any structures. Investors in land might hold onto it for price appreciation or pursue development for residential or commercial projects, alternatively selling to developers or construction firms. Land investments can be highly profitable but carry significant risks and challenges, including substantial upfront costs and environmental considerations.

Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts, or REITs, are entities that own, manage, or finance income-generating real estate. By purchasing shares in REITs, investors can engage in real estate endeavors indirectly, akin to investing in stocks or mutual funds. REITs open the door to real estate investment without the burdens of direct property management, accompanied by benefits like regular dividend payments and certain tax efficiencies. For those interested in the broader aspects of real estate careers, our post on Is Real Estate The Right Career Path For You? Exploring The Pros And Cons offers a comprehensive overview.

Essential Skills for Every Real Estate Investor

Real estate investing demands a thorough skill set, encompassing knowledge, talent, organization, networking, and perseverance. Achieving success in this competitive field hinges on the mastery of key skills, empowering you to make informed and lucrative investment decisions.

Market Analysis

At the core of effective real estate investing is the capability to conduct thorough market analysis. This involves researching and interpreting the current and future market trends, understanding supply and demand dynamics, analyzing demographics and competition, and assessing the opportunities and risks in your target market. Mastering market analysis enables you to pinpoint the prime locations, properties, and investment strategies. Getting a Sacramento real estate license or a San Diego real estate license would be beneficial as both areas continue to grow fast.

Financial Analysis

Essential to real estate investment is financial analysis—the skill to assess the financial standing and potential of your investments. It’s crucial to be adept at calculating and deciphering key financial metrics, including cash flow, return on investment (ROI), net present value (NPV), internal rate of return (IRR), and capitalization rate (cap rate). Proficiency in financial analysis is vital for evaluating the value, profitability, and viability of your investment endeavors.

Negotiation Skills

Negotiation skills are paramount, enabling you to engage effectively and convincingly with various stakeholders in a real estate deal. Effective negotiation involves the ability to establish rapport, listen actively, pose questions, address objections, and seal deals successfully. Honing your negotiation skills can significantly impact securing advantageous pricing, terms, and conditions for your investments.

Property Management

Expertise in property management is instrumental in sustaining and enhancing the value of your real estate holdings. This includes the capability to locate and vet tenants, manage rent collection, oversee repairs and maintenance, address tenant complaints and issues, and ensure compliance with relevant laws and regulations. Effective property management is key to boosting rental income, minimizing expenses, and avoiding legal issues.

Legal Compliance

Legal compliance entails grasping and adhering to the myriad of rules and regulations that are pivotal in the real estate sector. It’s essential to be well-versed in the specific laws and codes relevant to your properties. This includes areas such as zoning, building, environmental, tax, and contract laws.

By ensuring legal compliance, you safeguard your investments from potential fines, penalties, and lawsuits, not to mention disputes that could otherwise put your assets at risk.

Strategies for Successful Real Estate Investing

Real estate offers diverse investment opportunities, each presenting unique benefits and challenges. Whether you’re driven by specific financial goals, have a set budget, or a certain level of risk tolerance, there’s a strategy that can cater to your requirements, helping you to increase your wealth and achieve your investment objectives.

Long-term Rentals

Investing in long-term rentals involves purchasing properties to lease to tenants for extended periods, typically over a year. This approach can provide you with a steady source of passive income through rent payments, tax deductions, and property depreciation, alongside the potential for property value appreciation over time. For those interested in long-term rental investments, obtaining a real estate license can be particularly beneficial. It not only enhances your market knowledge and negotiation skills but also allows you to handle leasing and property management independently. This can lead to cost savings and greater control over your investments. Learn more about the online real estate courses and how it can streamline your investment process through our specialized school.

This strategy is ideal for investors looking to establish a reliable cash flow, who possess the patience and management capabilities for handling property and tenant issues, and who have the necessary capital and credit for property acquisition and upkeep.

Flipping Properties

Property flipping is about acquiring underpriced or distressed properties, refurbishing them, and then selling them at a profit, generally within a year. This method can yield significant one-time profits, capitalize on market trends and opportunities, and utilize your innovative skills and property value enhancement expertise.

It’s best suited for investors experienced in identifying promising deals, those who have the financial resources for buying and renovating properties, and who can devote the time and effort to oversee projects and finalize sales. For those considering flipping houses, our post on Do You Need A Real Estate License To Flip Houses? provides essential information.

Wholesaling

Wholesaling involves locating properties from sellers eager to sell, then transferring or selling these contracts to other investors for a commission or profit margin. This strategy enables you to earn without the need for direct property ownership or financial involvement, minimizes your risk and responsibility, and allows for rapid business expansion.

It’s appropriate for investors with strong networking and marketing capabilities to generate leads, excellent negotiation and communication skills for sealing deals, and a solid understanding of the legal and ethical aspects necessary for industry compliance.

Real Estate Crowdfunding

Real estate crowdfunding pools funds from various investors to finance real estate projects or portfolios, often facilitated through online platforms. This method offers entry into varied real estate sectors—including residential, commercial, industrial, or land—with minimal capital, benefits from the expertise of professional management, and appreciates the substantial returns and tax benefits of real estate.

Investors seeking a more passive real estate investment route, who are diligent in opportunity assessment and risk analysis, and who are patient and trustful enough to invest collaboratively will find this strategy fitting.

Risks and Rewards of Real Estate Investing

Investing in real estate comes with its share of uncertainties, complexities, and responsibilities, making it far from a risk-free venture. On the flip side, it promises significant benefits like income generation, property appreciation, and appealing tax advantages.

This part of our discussion highlights the predominant risks and rewards associated with real estate investments, aiming at a balanced perspective.

Risks

Here are some prevalent risks tied to real estate investments:

- Market risk: Influenced by numerous factors including supply and demand, economic scenarios, interest rates, demographics, and regulatory policies, the real estate market is prone to unpredictable fluctuations. These variations can directly impact the valuation, the potential for rent, and the profitability of your properties.

- Location risk: The appeal and demand for your property heavily rely on its location. A less desirable location can lead to reduced rental income, higher vacancy rates, and diminished property value. It’s crucial to rigorously research the neighborhood, available amenities, crime statistics, and future development plans of the area you plan to invest in.

- Negative cash flow: When the expenses of maintaining a property surpass the income it generates, negative cash flow occurs. Factors such as substantial maintenance costs, unexpected repairs, vacancies, issues with tenants, or decreased rental prices can contribute to this undesired situation. Negative cash flow can deplete your financial reserves and impede your capacity to cover mortgage and tax obligations.

- Property management: Encompassing maintenance, tenant acquisition and screening, rent collection, resolving complaints, and adhering to legal standards, property management demands considerable time, patience, and financial outlay. Opting for a professional property manager or delegating some responsibilities can erode your profit margins, though it might ease the operational burden.

- Legal compliance: Real estate investment is governed by a myriad of laws and regulations at the federal, state, and local levels. These legal frameworks, encompassing zoning, construction, environment, taxation, and contractual obligations, require your strict compliance to avert fines, penalties, litigations, and disputes that could put your investment at risk.

Rewards

Real estate investments are known for these attractive rewards:

- Rental income: One of the primary incentives of real estate investment is the rental income from tenants. This income stream can provide a reliable and continuous cash flow that may not only cover your expenses but also yield a profit. Additionally, rental income has the potential to rise over time through rent adjustments or property enhancements.

- Property appreciation: Over time, the value of your property can appreciate due to market trends, inflation, or strategic improvements. This appreciation boosts your equity, potentially enabling you to sell your property at a premium or secure more favorable refinancing options.

- Tax advantages: The tax system extends various benefits to real estate investors, such as deductions on mortgage interest, property taxes, depreciation, and operational expenses. Moreover, opportunities for exemptions or deferments on capital gains, passive income, and provisions for 1031 exchanges can significantly enhance the investment’s attractiveness.

Getting Started: Steps for Novice Investors

Starting on a real estate investing path requires preparation, clear vision, and strategic planning. To aid beginner investors in initiating their path in real estate, here are key steps to follow.

- Set your goals: Begin by outlining your investment objectives in real estate. Determine what you aim to achieve, your desired financial gain, investment duration, and your risk tolerance. Setting clear goals will guide you in selecting the most suitable strategy, market, and property for your investment.

- Educate yourself: Acquaint yourself with real estate investing fundamentals, including terminology, concepts, methods, and applicable laws. Enhancing your knowledge through books, blogs, podcasts, articles, courses, seminars, webinars, and participating in online forums and communities is vital for making informed decisions.

- Organize your finances: Assess your financial situation, including income, expenses, assets, liabilities, and credit score, to determine your investment capacity. Decide on your financing method, whether through cash, loans, partnerships, or other means, and ensure you have reserves for unforeseen costs.

- Get pre-approved: If you plan to finance your investment, securing pre-approval for a mortgage or loan is essential. Pre-approval provides insight into your borrowing capacity, interest rate, and terms, demonstrating your seriousness and qualification to sellers and agents, thus strengthening your position in negotiations.

- Find your niche: Identify a real estate investment niche that aligns with your goals, budget, and skills. Whether it’s residential, commercial, land, or REITs, or strategies like long-term rentals, flipping, wholesaling, or crowdfunding, focusing on a niche enhances your expertise.

- Choose your market: Selecting the right market is essential for identifying profitable investment opportunities. Research to understand market dynamics such as supply and demand, demographics, and competition, along with factors impacting property value and rentability like economic conditions, infrastructure, and development plans.

- Pick a neighborhood: Narrow your property search to a specific neighborhood within your chosen market. By evaluating the area’s appeal, condition, and potential, and engaging with locals, agents, and landlords for insights, you can pinpoint the best investment deals and tenants. Our guide on 9 Cities In California All Aspiring Real Estate Agents Should Know In 2024 will be helpful.

- Analyze deals: Conduct thorough analyses of potential investment properties to assess their financial performance and potential. Key metrics to compare include cash flow, return on investment, net present value, internal rate of return, and cap rate, alongside inspecting the property and estimating repair and maintenance costs.

Final Thoughts

Real estate investing offers a promising avenue for generating income and building wealth. Nevertheless, it demands thorough preparation, extensive knowledge, and honed skills. Through this article, we’ve laid out key insights for beginners eager to invest in real estate.

We’ve discussed various investment types within real estate, essential skills for success, strategies to enhance your returns, and the expected risks and rewards. Moreover, we’ve outlined actionable steps to start your investment journey.

Armed with a robust understanding of real estate investing, you’re now poised to take proactive steps towards your investment goals. Remember, hands-on experience is invaluable—embrace mistakes as learning opportunities.

With continued practice, your proficiency and confidence as a real estate investor can lead to the lifestyle you’ve been dreaming of.

California Real Estate Licensing Trends: October 2023

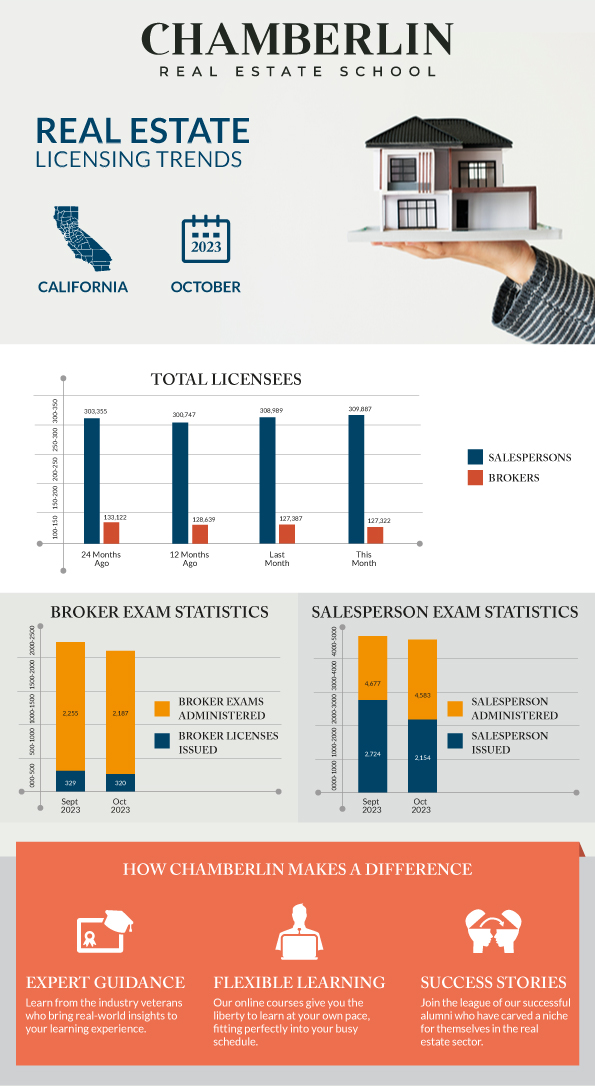

How Many Brokers & Salespersons Are Licensed in California?

According to the CA Department of Real Estate (DRE), here are the total number of Brokers and Salespersons licensed in October 2023 compared to September 2023. The numbers also show the total amount of licensees from 1 year ago and 2 years ago.

- Brokers:

- This Month: 127,187

- Last Month: 127,322

- 12 Months Ago: 128,604

- 24 Months Ago: 133,598

- Salespersons (Agents):

- This Month: 310,024

- Last Month: 309,887

- 12 Months Ago: 301,843

- 24 Months Ago: 305,685

Breaking Down the Trends

A Growing Salespersons’ Community

You might notice there was a decrease of roughly 3,800 Salesperson licensed 2 years ago compared to the total number licensed only a year ago. One would think the number of agents would continue to become lower considering the real estate market was dealing with a large increase in interest rates. The opposite actually occurred, and the number of licensed agents increased up to 310,024 in October of 2023. That was an increase of almost 9,000 licensed individuals in one year.

Brokers: The Backbone of the Industry

Although there is a slight dip in the number of brokers compared to the previous years, their substantial presence in the industry signifies the overall strength of the market. Becoming a broker opens up avenues for higher responsibilities and rewards. If you aim for a position of leadership, pursuing a broker’s license is a great step to take.

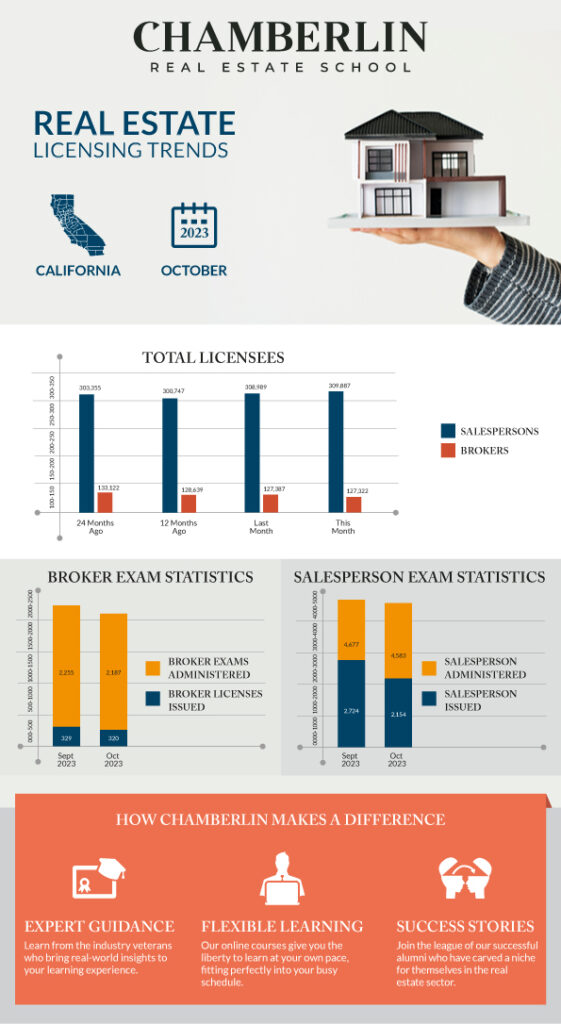

California Salesperson Licenses Issued vs Exams Administered

- New Salesperson Licence Issued (Agent)

- This Month: 2,154

- Last Month: 2,724

- 12 Months Ago: 2,991

- Salesperson (Agent) Exams Administered

- This Month: 4,583

- Last Month: 4.677

- 12 Months Ago: 4,716

What Is The Passing Rate of The California Real Estate Exam?

As you can see, over half of the people who took the state exam did not pass and get their license in October. Only 47% of test takers were issued a California real estate license that month. The September numbers were much better with 58% of the passing students obtaining a license. One year ago in October 2022, about 63% of people passed the exam and were licensed. From what we have seen, the average number of people each year who pass is 50% or less.

California Broker Licenses Issued vs Exams Administered

Here are the October and September number of Broker examinations taken and Broker licenses issued:

- New Broker Licenses Issued

- This Month: 320

- Last Month: 329

- 12 Months Ago: 395

- Broker Exams Administered

- This Month: 2,187

- Last Month: 2,255

- 12 Months Ago: 2,991

Why do so many brokers fail the state exam? In October, 2,187 people took the Broker exam, and only 320 passed. That means only 14.6% of the people who took the exam passed and received a broker license. September was not any better with 14.5% of examinees passing and getting licensed. The Broker exam is more difficult than the Salesperson exam. It contains 50 more questions and you must pass with a 75% or higher score. These statistics show if you do become a broker you will be certifiably more knowledgeable than your peers. This is a unique selling point when obtaining new clients.

How Chamberlin Makes a Difference

The process to get your real estate license or broker license is confusing. Which courses do you need to take? Why does the DRE require Brokers to take so many classes? We help people with all these questions and provide DRE-accredited coursework so you can qualify to take the state exams. Our success is also attributed to our exam preparation and crash course which helps both Brokers and potential new agents prepare. Other characteristics include:

- Expert Guidance: Learn from the industry veterans who bring real-world insights to your learning experience.

- Flexible Learning: Our online courses give you the liberty to learn at your own pace, fitting perfectly into your busy schedule.

- Success Stories: Join the league of our successful alumni who have carved a niche for themselves in the real estate sector.

Feel free to reach out to us, and we’ll be happy to guide you at every step.

6 Essential Considerations for Choosing Your Real Estate Brokerage

Choosing the right brokerage is a often the scariest decision for aspiring real estate agents. It’s about finding a match that supports your career goals and works well with the foundational knowledge you gain through your licensing education. Let’s explore six key factors to consider when making this choice.

Training and Education

- Continuous Learning: Brokerages that prioritize education might offer weekly market trend webinars, monthly sales strategy workshops, and even provide access to annual real estate conferences to ensure their agents are well-versed in the latest industry practices and standards. This ongoing training can help you stay updated on the latest industry trends and regulations.

- Complementary Education: The right brokerage will offer training that complements what you’ve learned in licensing courses, providing a seamless transition from education to practice. They will also show you where to get your real estate continuing education so your license never expires.

- Chamberlin’s Edge: At Chamberlin Real Estate School, we give you the foundational knowledge, which can be built on by the training provided by your brokerage.

Company Culture

- Workplace Dynamics: Evaluate how a brokerage’s work environment and dynamics align with your expectations. Whether it’s a competitive atmosphere or a collaborative one, it should suit your working style.

- Shared Values: It’s essential to join a brokerage whose values align with yours. Whether it’s a commitment to sustainability, community involvement, or innovation, these shared values can enhance job satisfaction.

- Ethical Standards: We ensure our students at Chamberlin Real Estate School understand the importance of ethics, which is something you’ll want to see reflected in your brokerage’s culture.

Marketing and Tech Support

- Marketing Tools: A brokerage with a strong marketing platform can offer you tools like listing syndication, a personal website, and social media management, which can greatly increase your visibility and lead generation.

- Tech Resources: From CRM systems to mobile apps, the tech support provided by a brokerage can significantly impact your efficiency and ability to serve clients effectively.

- Chamberlin Prep: We prepare students with an understanding of how technology is used in real estate so they can quickly adapt to a brokerage’s tools and platforms.

Mentorship and Support

- Structured Mentorship: Some brokerages may pair you with top-performing agents who will guide you through your first few sales, offering hands-on advice on everything from crafting compelling listings to negotiating deals. Others might have formal mentorship programs that include shadowing opportunities, weekly one-on-one coaching sessions, and access to an experienced agent’s insights on building a successful client base.

- Support Networks: Look for brokerages that have a clear support system, whether it’s administrative assistance or access to a knowledgeable help desk for when you have questions.

Business Model Flexibility

- Workspace Options: Today’s brokerages vary from traditional office setups to modern, virtual platforms. Your preference for a fixed location versus the ability to work remotely should inform your choice.

- Adaptable Schedules: Some brokerages offer adaptable schedules that can help manage the demands of personal life and work, which is crucial for maintaining a healthy work-life balance.

- Learning Your Way: Chamberlin Real Estate School offers online real estate courses, providing the kind of flexibility that you’ll enjoy as a real estate agent.

Commission and Transparency

- Clear Commission Structures: Understanding how you’ll be paid is crucial. Look for brokerages with clear and fair commission structures that offer a good balance between your effort and earnings. For example, some brokerages may offer a traditional split where you receive a set percentage of every transaction. Others might have a 100% commission model where you pay a flat fee per transaction or monthly office fee instead of sharing a percentage of your commissions. Graduated commission splits that increase as you reach certain sales thresholds within a year can also be available, rewarding agents for higher performance.

- Upfront Financial Discussions: A brokerage that is transparent about costs such as desk fees, transaction fees, and other potential expenses shows that they value honesty and your financial well-being.

- Financial Insight from Chamberlin: We educate our students on the various commission structures and what they can mean for their income, helping them to make informed decisions when choosing a brokerage.

Closing Thoughts

Selecting the right brokerage can set the stage for a fruitful real estate career. It’s a decision that should be made with care, considering how well a brokerage’s offerings align with the education and values you hold. Chamberlin Real Estate School aims to provide you with the knowledge and skills needed to make the best choice for your future in real estate.

Ready to take the first step? Enroll with Chamberlin, a California Real Estate School where successful careers start!

The 18 Best Real Estate Blogs for New Agents to Follow

Real estate is filled with endless opportunities to learn, grow, and make a significant impact on people’s lives. However, breaking into this competitive field requires a well-rounded understanding of the market, legal regulations, and effective selling strategies. Reading reputable real estate blogs is a practical way to quickly amass a wealth of industry insights. Whether you’re looking to stay updated on the latest market trends or seeking advice on kickstarting your real estate career, following the right blogs can provide a solid foundation. Here are 18 of the best real estate blogs that every aspiring agent in California should follow to navigate through the real estate waters successfully.

National Association of Realtors (NAR) Blog

The official blog of NAR offers a plethora of resources and insights into the real estate industry, making it a must-follow for aspiring agents.

Inman

If staying updated with the latest news in the real estate industry is what you’re after, Inman is your go-to resource. Inman offers a wide range of articles on market trends, legal matters, and technological advancements, giving a comprehensive view of the real estate industry.

The Close

The Close offers an excellent mix of marketing tips, tech advice, and actionable strategies for real estate agents aiming to elevate their careers.

ActiveRain

ActiveRain offers a community blog platform where real estate professionals share their insights and experiences, providing a real-world glimpse into the real estate industry.

Zillow Porchlight

Zillow Porchlight offers a balanced mix of real estate tips, market analysis, and home improvement ideas. For new agents, understanding what homebuyers are looking for is crucial, and this blog provides just that.

Redfin Blog

Redfin Blog delves into current market trends and provides a plethora of tips for both agents and homebuyers. The practical advice offered on this blog can significantly shorten the learning curve for new agents.

Realtor.com Blog

With a wide range of topics covered, Realtor.com Blog is a treasure trove of information. From market trends to professional advice for agents, it provides an extensive knowledge base.

BiggerPockets Blog

BiggerPockets is ideal for those interested in real estate investment. It provides a platform to learn and discuss various real estate investment strategies, making it a valuable resource.

Tom Ferry Blog

Gain insights from Tom Ferry, a renowned real estate coach who shares valuable tips on sales, marketing, and mindset to help you succeed in your real estate career.

Fit Small Business Real Estate

This blog is an excellent resource for real estate education, marketing tips, and general business advice, designed to help new agents thrive.

Geek Estate Blog

Geek Estate Blog focuses on real estate technology and internet marketing strategies, which are crucial in today’s digital-driven market.

RISMedia

RISMedia is a reputable source covering real estate news and trends. It also provides educational articles beneficial for new agents wanting to expand their knowledge.

Coach Carson

Learn about real estate investing basics and financial independence from a real estate perspective with Coach Carson.

CRE Online

Focusing on real estate investing, CRE Online provides articles and forums discussions beneficial for both new and seasoned investors.

PropertyShark Real Estate Blog

Stay updated with market trends, real estate news, and interviews with industry professionals through the PropertyShark Real Estate Blog.

Real Estate Tomato

This blog concentrates on online marketing strategies for real estate agents, a skill vital for success in the modern market.

HousingWire

Delve into real estate finance and the mortgage sector with HousingWire, aiding in understanding the economic aspect of real estate.

LuxuryRealEstate.com Blog

If luxury real estate is your jam, this blog focuses on high-end properties and luxury market trends, providing a unique perspective.

Closing Thoughts

Equipping yourself with a diverse knowledge base is essential for a successful career in real estate. Following these recommended blogs will not only keep you informed about the latest industry trends but also offer a wealth of tips and strategies to help you excel in your career. As you continue on this learning journey, consider taking the next step by enrolling in Chamberlin Real Estate School’s online courses to prepare for the California real estate exam and embark on a rewarding career path.

Check out our course offerings and register today to take the first step towards achieving your real estate career goals in California. Stay informed, stay ahead, and let Chamberlin Real Estate School be your guiding partner in your real estate journey.

8 Things Every New Real Estate Agent Should Know

As a new real estate agent, you’re stepping into a competitive arena where your success hinges on a few key insights.

You’ll need to master personal branding and effective communication to build trust with clients, while also leveraging technology to enhance your visibility in the market.

Understanding the nuances of market cycles and time management will greatly influence your decision-making and productivity.

But these are just the beginning; there are important aspects you might not have considered yet that could make all the difference in your career.

What comes next could redefine your approach entirely.

Personal Branding and Relationships

In today’s competitive real estate market, crafting a unique personal brand is important for standing out and building trust with clients. Your brand should reflect your story and background, making it easier for potential clients to connect with you. By using personal storytelling in your interactions, you create relatability that not only makes you memorable but also encourages repeat business and referrals.

Consistency across all your marketing materials—like business cards and social media profiles—is important. It builds recognition and credibility, reinforcing your brand in the minds of potential clients.

Engage regularly with past clients through check-ins and appreciation events; these efforts strengthen client partnerships and foster long-term relationships.

When you view clients as long-term partners rather than mere transactions, you cultivate a sustainable client base. Your approach should focus on building meaningful connections that encourage trust and loyalty.

This perspective won’t only enhance your reputation but also contribute greatly to your business growth. In real estate, personal branding and relationships go hand in hand, so invest the time and effort to create a brand that resonates with your audience.

Technology and Marketing Strategies

Steering through the ever-evolving terrain of real estate requires savvy agents to embrace technology and effective marketing strategies. Utilizing Customer Relationship Management (CRM) systems can streamline your client interactions, enhancing relationship management and ultimately leading to increased sales and client retention.

Implementing virtual tours and augmented reality tools allows potential buyers to explore properties immersively from anywhere, greatly improving their experience. Coupled with digital marketing strategies—like SEO, targeted email campaigns, and social media advertising—you’ll boost your visibility and generate leads. Remember, 93% of online experiences begin with a search engine, so make sure you’re easily found.

High-quality professional photography is another game-changer. Listings with stunning visuals attract 61% more views than those with average photos, leading to quicker sales and higher offers.

Time Management and Productivity

Effective time management is key for new real estate agents working hard to succeed in a competitive market. To enhance productivity, allocate specific hours each week for client meetings, property showings, and administrative tasks. This structured schedule not only organizes your time but also helps to prevent burnout by setting clear boundaries between work and personal life, allowing you to recharge.

Incorporate time management techniques like time blocking to prioritize tasks effectively. By designating chunks of time for specific activities, you can focus better and accomplish more. Reserve a minimum of two hours weekly for market research and networking to stay informed and build valuable connections.

Don’t hesitate to embrace task delegation. By outsourcing administrative tasks like data entry or social media management to assistants or utilizing automation tools, you can concentrate on your core business activities. This strategic approach not only frees up your time but also enhances your overall productivity.

Effective Communication Skills

Mastering communication skills can make or break your success as a new real estate agent. Timely and professional responses to client inquiries are important; research shows that replying within five minutes greatly boosts your chances of converting leads into clients.

Practicing clear communication helps you avoid misunderstandings, particularly when you simplify complex real estate terms for your clients.

Active listening is another key component of effective communication. Studies indicate that honing your listening skills can improve client satisfaction by 30%, allowing you to build stronger relationships and respond to their needs more effectively.

Regular follow-up communication also matters; maintaining contact can elevate client retention rates by 25%, showcasing your commitment and fostering trust.

Lastly, don’t underestimate the importance of negotiation skills. Agents who excel in negotiation can secure deals that are 10-15% better for their clients, ultimately enhancing your reputation and success in the industry.

Understanding the Market

Building strong communication skills lays the groundwork for your success, but understanding the real estate market is just as fundamental. Familiarizing yourself with market cycles—phases of boom, bust, and recovery—will help you anticipate shifts in demand and adapt your pricing strategies accordingly.

Conducting a Comparative Market Analysis (CMA) is critical. This process allows you to evaluate property valuation based on recent sales, current listings, and prevailing market conditions in your local area. Keep a close eye on economic indicators like job growth, interest rates, and inventory levels, as these factors directly influence real estate pricing and buyer behavior.

Additionally, analyzing local trends, such as demographic shifts and neighborhood fluctuations, enables you to tailor your strategies to meet the specific needs of your target market.

Staying informed about California real estate regulations and laws is also significant; this guarantees compliance and positions you to provide clients with accurate, relevant advice.

Continuous Learning and Development

Embracing continuous learning is significant for new real estate agents looking to thrive in a competitive market. Staying updated on industry regulations, market trends, and best practices is key to remaining knowledgeable and competitive.

Attend seminars, workshops, and webinars regularly to enhance your skills and create valuable networking opportunities with industry professionals.

Pursuing specialized industry certifications, such as those in property management or commercial real estate, can notably differentiate you from your competitors. These certifications not only expand your service offerings but also demonstrate your commitment to professional growth.

In addition, engaging with industry publications, blogs, and newsletters guarantees you’re informed about the latest news, emerging technologies, and changes in real estate laws that could impact your practice.

Many states require continuing education for license renewal, emphasizing the importance of ongoing professional development.

Seek out mentorship opportunities, as learning from experienced agents can provide invaluable insights and guidance.

Financial Management

As you commence your real estate career, understanding financial management is key for achieving long-term success. Effective financial management can help you maximize your earnings and prepare for future growth. Here are three key areas to focus on:

1. Commission Structures: Familiarize yourself with typical commission rates, usually ranging from 5% to 6%, and understand how splits with your brokerage affect your take-home pay.

2. Budgeting Strategies: Anticipate spending 10% to 30% of your income on important expenses like marketing, technology, and education.

Create a budget that accounts for these costs to guarantee financial stability, especially during your first year.

3. Tax Planning: Set aside 25% to 30% of your earnings for taxes. Since real estate commissions are subject to self-employment and income tax, proper tax planning is critical.

Utilizing accounting software to track your income and expenses will help you maintain financial health and prepare for tax season.

Additionally, seeking financial advice and exploring investment opportunities, like real estate syndicates or rental properties, can further grow your wealth beyond just commissions from sales.

Licensing and Regulations

Navigating the complex terrain of licensing and regulations is critical for new real estate agents aiming to establish a successful career. Each state has unique licensing requirements that you’ll need to navigate, including pre-licensing education, passing an exam, and fulfilling continuing education credits for license renewal.

For instance, in California, agents must complete 45 hours of continuing education every four years, focusing on ethics, agency, and fair housing courses.

Beyond licensing, understanding regulatory compliance is important. You must familiarize yourself with federal, state, and local regulations, particularly fair housing laws that prevent discrimination based on race, color, religion, sex, national origin, familial status, or disability.

Moreover, knowing local zoning laws is key, as these regulations dictate land use, building codes, and property development, which directly impact property values and marketability.

Lastly, adhere to the National Association of Realtors’ Code of Ethics, which promotes professionalism and integrity in all agent-client relationships.

Frequently Asked Questions

How Do I Choose the Right Brokerage to Join?

To choose the right brokerage, evaluate their culture, commission structure, training programs, and technology resources. Consider marketing support and location benefits, and seek agent mentorship to align with your career goals and guarantee long-term success.

What Are the Best Networking Strategies for New Agents?

To build your network, engage on social media, attend community events, join networking groups, participate in online forums, and seek mentorship programs. Local meetups also offer significant opportunities to connect and grow your professional relationships.

How Do I Handle Difficult Clients or Situations?

When handling difficult clients, prioritize client communication and active listening. Stay calm to facilitate conflict resolution, set clear expectations early, and show empathy. Document interactions to maintain clarity and support your position when needed.

What Types of Insurance Do Real Estate Agents Need?

As a real estate agent, you need professional liability and errors omissions insurance to protect against claims. General liability covers bodily injury, while business insurance safeguards your office assets. Don’t overlook these key protections.

How Can I Build a Referral Network Quickly?

To build a referral network quickly, engage actively on social media and participate in community events. Showcase your expertise online, and foster relationships locally to encourage word-of-mouth referrals and strengthen your professional connections.

Conclusion

In your expedition as a new real estate agent, mastering these important elements will set you up for success. By focusing on personal branding, effective communication, and leveraging technology, you’ll build strong relationships and enhance your visibility. Stay informed about market trends, manage your finances wisely, and adhere to licensing regulations to guarantee compliance. Embrace continuous learning to remain competitive in this vibrant industry. With dedication and the right strategies, you’ll thrive in your real estate career.

9 Cities in California All Aspiring Real Estate Agents Should Know in 2024

From the Gold Rush era, which saw a massive influx of settlers, to the tech boom of recent decades, California’s real estate market has always been in flux. This dynamic history, combined with an abundance of local amenities ranging from world-class dining establishments to renowned educational institutions, makes our state ideal for new real estate agents. If you’re just starting out, the city you select can play a pivotal role in shaping your career. Here’s a comprehensive look at the top 9 cities in California ideal for budding real estate agents:

San Jose, California:

The Tech Giants’ Playground

- Historical Insight: Once a farming community, San Jose’s transformation into the tech capital is nothing short of remarkable.

- Overview: Nearing a population of 1 million, San Jose is the pulsating heart of Silicon Valley.

- Real Estate Highlight: A staggering $568 billion in real estate, and a median home value of $1.1 million.

- Local Amenities: Numerous tech museums, cultural festivals, and a vibrant nightlife.

- Fun Fact: The city is home to the Winchester Mystery House, a mansion with maze-like hallways and staircases that lead to nowhere, built by the widow of the inventor of the Winchester rifle.

Los Angeles, California:

The Star-Studded Metropolis

- Historical Insight: From a small pueblo to the entertainment capital, LA’s growth is intertwined with the rise of Hollywood.

- Overview: A sprawling cityscape known for its celebrities and iconic landmarks.

- Real Estate Highlight: A diverse housing market from luxurious mansions to chic apartments.

- Local Amenities: World-class theaters, museums, and the Hollywood Walk of Fame.

- Fun Fact: Beneath downtown LA, there are old tunnels that were used for bootlegging during the Prohibition era.

- Navigating the star-studded real estate market requires unique skills, as discussed in Luxury Real Estate in California: Is It Right for You?, which can help new agents decide if this segment suits their career goals.

San Diego, California:

The Sunlit Beach City

- Historical Insight: San Diego’s history is rich with Spanish influence, evident in its architecture and culture.

- Overview: Famous for its beaches and military presence.

- Real Estate Highlight: Consistent housing demand due to its coastal charm.

- Local Amenities: The San Diego Zoo, historic Old Town, and naval museums.

- Fun Fact: The city’s Coronado Beach sands sparkle because of the presence of mica, a mineral that gives it a golden sheen.

- Understanding the market’s nuances is crucial for success, especially for those interested in Eco-Friendly Real Estate: A Lucrative Path For California’s Next Generation Of Agents, given San Diego’s push towards sustainability.

Sacramento, California:

The Golden Capital

- Historical Insight: As the endpoint of the Gold Rush, Sacramento has always been pivotal to California’s growth.

- Overview: The state capital experiencing a population boom.

- Real Estate Highlight: Rising demand for suburban homes.

- Local Amenities: Historic parks, museums, and a vibrant arts scene.

- Fun Fact: The city has an underground historic district, remnants of the raised streets and buildings from the 1860s and 1870s.

San Francisco, California:

The Iconic Bay City

- Historical Insight: From the Gold Rush to the tech rush, San Francisco’s real estate has seen dramatic shifts.

- Overview: One of the most expensive cities in the U.S.

- Real Estate Highlight: Skyrocketing property values.

- Local Amenities: The Golden Gate Bridge, Alcatraz Island, and tech hubs.

- Fun Fact: The Fortune Cookie was introduced to America by a San Francisco bakery, even though it’s often associated with Chinese culture.

Fresno, California

The Agricultural Marvel

- Historical Insight: Fresno’s growth is deeply rooted in its agricultural prowess.

- Overview: More than just farms, it’s a city with a growing urban appeal.

- Real Estate Highlight: Rising residential property demand.

- Local Amenities: The Fresno Chaffee Zoo, cultural festivals, and local wineries.

- Fun Fact: Fresno is home to the “Forestiere Underground Gardens,” a unique subterranean network of patios and grottoes.

Oakland, California:

The Diverse Bay Gem

- Historical Insight: Once overshadowed by San Francisco, Oakland’s growth in the 20th century cemented its place in California’s real estate map.

- Overview: A city known for its cultural diversity.

- Real Estate Highlight: A blend of urban and suburban offerings.

- Local Amenities: Lakeside parks, art deco theaters, and a rich music scene.

- Fun Fact: The city is home to the oldest wildlife refuge in the U.S., the Lake Merritt Bird Sanctuary.

Long Beach, California:

The Harbor City

- Historical Insight: Long Beach’s development has always been tied to its port, one of the world’s busiest.

- Overview: A coastal city attracting both locals and tourists.

- Real Estate Highlight: Growing demand for waterfront homes.

- Local Amenities: The Queen Mary, Aquarium of the Pacific, and annual Grand Prix.

- Fun Fact: The city’s Rancho Los Alamitos has trees that are over 400 years old.

Bakersfield, California:

The Oil and Agriculture Hub

- Historical Insight: Bakersfield’s growth can be attributed to its oil discoveries and agricultural successes.

- Overview: A city on an upward trajectory.

- Real Estate Highlight: Affordable housing perfect for newcomers.

- Local Amenities: Music festivals, local theaters, and the Kern County Museum.

- Fun Fact: The city holds the record for the world’s largest ice cream sundae, created in 1985.

Closing Thoughts

As you consider where to start your real estate career, it’s essential to also think about the foundational steps of becoming a licensed agent. Choosing the right pre-license course is just as crucial as selecting the right city to launch your career. Chamberlin Real Estate School provides a detailed breakdown of how salesperson pre-license courses work, guiding you through the process from start to finish. If you like what you see, we hope you’ll join us soon!